Time Value of Money and Financial Strategies in the Architectural Industry

Understanding the economic costs of "pay-when-paid" in the architectural industry.

What is the True Cost of Slow Pay?

So, what does it mean for the $100k invoice to be paid six months into the future? It means you can say goodbye to $10k of economic value.

This article will delve into the principles of the time value of money (TVM) and their significant impact on architectural and engineering (AE) firms. We will explore how payment delays affect these firms economically and introduce strategic financial solutions, mainly focusing on owner financing of invoices. We’ll review fundamental financial concepts like present and future value and learn how to apply these principles to optimize economic outcomes in your architectural or engineering practice. By the end, you'll be equipped with actionable insights to enhance cash flow management and maximize profitability, transforming financial challenges into opportunities for growth.

Time Value of Money

You may remember doing these calculations in econ class, but let’s review them so we can apply them directly to our industry.

Key Concepts

Present Value (PV): The current value of future cash flows discounted at a specified rate.

Future Value (FV): The value of an investment or cash flow at a future date, given a specified rate of return.

Example:

An architectural firm invoices $100,000 for services rendered, expecting payment immediately, but does not receive payment until six months into the future. Considering the owners’ expected return of 20%, what is the present value of this payment?

To calculate the present value (PV) of an invoice paid six months into the future, considering an investor's expected return of 20%, we use the formula for present value with compounded interest:

Where:

FV is the future value (in this case, the amount of the invoice, say $100,000),

r is the annual interest rate (20% or 0.20 as a decimal),

t is the time in years (6 months is 1/2 year).

First, calculate the monthly interest rate:

Now, calculate the present value (PV) using the formula for present value with monthly compounding interest:

Where n is the number of compounding periods (in months).

Since we have six months:

Now, compute:

Therefore,

Economic Impact of Payment Delays

In technical terms, this reflects today's discounted value of receiving $100,000 six months from now, with interest compounding monthly at 20% per annum.

Why 20%? We use a 20% discount over this period because you would otherwise have earned 20% returns by investing the capital directly into billable operations.

To complicate matters, you may need to borrow money to fund continued operations while you wait for payment. If you aren’t established, you might have difficulty finding favorable financing terms. You may need to borrow from hard money lenders, who provide fast playdowns and extremely high interest rates.

Let’s compare the economic consequences of payment delays and high-interest borrowing to the ideal payment scenario.

Scenario Analysis

Scenario 0: Invoice Paid Immediately (Ideal Scenario)

Your firm receives payment promptly after invoicing.

Net profit is $16.7k

No economic loss or gain.

Scenario 1: Delayed Invoice Payment + Hard Money Borrowing

Your firm faces a six-month payment delay and borrows $100,000 from hard money lenders at 37% APR for six months to cover operational costs.

Your firm suffers $10k economic loss

Return on Capital decreased by 164%

Owner Financing Invoice Balances

AE firms are giving out 0% interest loans with no monthly payments, only to be paid in full whenever the money upstream for the balloon payment becomes available. From an economics point of view, this feels like the worst possible financial decisions AE firms can make, yet it is a common and often expected practice.

If you don't receive the full payment when it's due, you should at least be compensated with monthly payments that include interest. This interest rate should match what you could earn if you invested the money in billable work for your firm.

In other words, consider offering owner-financed invoice loans to your clients. This approach ensures your assets work for you rather than against you.

Let's delve into the advantages of owner-financing invoices to enhance your financial returns.

Scenario Analysis

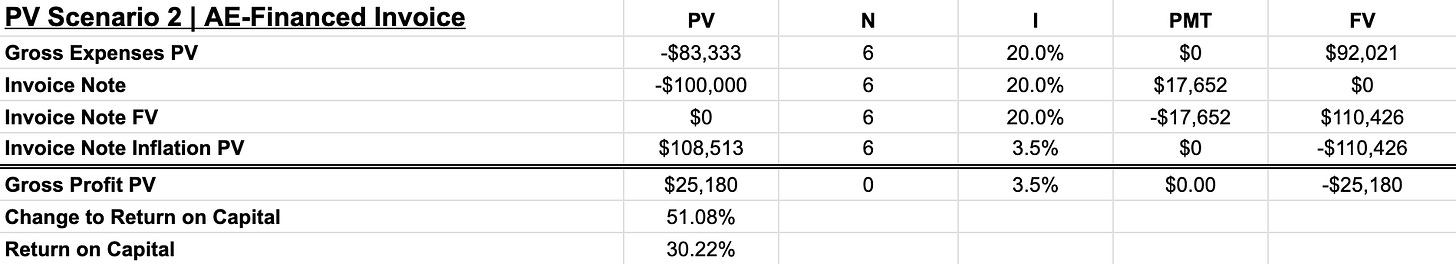

Scenario 2: AE Private Financing

Your firm creates an owner-financed loan to the buyer at a 20% annual interest rate over six months.

Cashflow prevents the need to borrow hard money.

Your firms total profits now exceed $25k (compared to the original $16.7k in Scenario 0)

Return on capital increases by 51.08%

Conclusion

Understanding the time value of money is crucial for architectural firms dealing with payment delays and financial challenges. By using smart financial strategies like owner financing invoices, firms can better manage their cash flow and achieve better economic outcomes.

If you’re an architect or an engineer, I’m sure you’ve also been bored in ECON 202; but these fundamental concepts of present and future value should transform how you see the real impact of slow payments in the AE industry. Simple payment negotiations can boost your profits and help you handle the challenges of "pay-when-paid" practices.

Also, always consult with your tax professional and legal counsel. We’re just talking high-level here to demonstrate a point.

Inspired by the book "Invest in Debt" by Jimmy Napier, this article aims to help those in the industry master these concepts and improve their business returns. If you want to grow your architectural or engineering firm, Mr. Napier's book is a must-read.